How to Create an Accounting Spreadsheet/Income Tax Calculator with Excel.

There is Light at The End of The Tunnel!....

It has indeed been an awesome experience at the Side Hustle Bootcamp program. Basically, if you were to ask me why the title of my post says "There's light at the end of the tunnel" I may tell you that next week marks the end of our Bootcamp program at Side Hustle, so I'm super excited as everyone in my team will be as well.

But that's on a lighter note, smiles.... I will like to share with you in this post, as this was what brought me here at the first instance, Lol. So, I will be discussing with you on How to Create an Accounting Spreadsheet/Income Tax Calculator with Excel

This may sound interesting to you on how it can be to create an accounting spreadsheet, but in this post I will like to satisfy your curiosity about this topic.

Let's go....

INTRODUCTION

What comes to your mind when you hear about an accounting spreadsheet; Accounting Worksheet is a spreadsheet tool that records all accounting information and is used to prepare the company’s financial statements at the end of the accounting cycle, thereby ensuring its financial accuracy. Furthermore, this tool is especially useful for accountants, financial analysts, and business people to analyze business performance numbers and results.

Spreadsheets allow accountants to do much more than organize data. They can manipulate it in order to test the impact that alternative strategies and performance results would have on the company’s bottom line. They can also use the software to make projections about future performance, development, and even market trends. Without the help of accounting packages, spreadsheets are often used to prepare financial statements, budgets, and stock analysis reports. Since this tool is so versatile and easy to use, it can also increase the analysis time, review capabilities, and understandability of reports.

On the otherhand, an income tax calculator is a worksheet for taxpayers with a net income of more than $100,000. Those with less than $100,000 in earnings can use the tax tables in order to figure out tax.

However, not everyone needs to use the tax computation worksheet or the tax tables.

First of all, you need to know that - in some regions, income tax is taken by your company accountant from your income. Conversely, you can calculate the income tax by yourself in some regions. Thus, this post will help both users to calculate income tax in Excel. You can keep all details of your income, expenses, and expenditure in an Excel worksheet. From here, you can easily calculate the income tax on the stored data.

How to Create an Income Tax Calculator In Excel

Business and Taxation go hand in hand. However, taxation calculations are most of the time tedious and if you need to make a small change you might have to punch millions of calculator keys again to get the tax liability calculated. But we have a rescue pack for you in the name of Excel! Many accountants have been using excel power to calculate income tax, sales tax or other different types of taxes very easily using excel in the blink of an eye. And if taxation rules have not changed then you can use the old excel file for next period.

A user can calculate his/ her income tax in MS Excel in a few steps; one of them is the calculation of the Income Tax. There are three ways of income tax deduction from the incomes if a user is working in some company, they will deduct all income-related taxes from the user’s salary where the user needs to declare the income tax himself.

There are a few steps on how to calculate your income tax in Excel which includes:

- Calculate Simple Taxable Income and Income Tax of that Income

- Calculate Taxable Income and Income Tax with Different Tax Slab

- Calculate Taxable Income and Income Tax with Different Tax Slab and Tax Surcharge

Each of these simple processes have a peculiarity when creating an income tax calculator in Excel.

PROCESS

The following steps were carried out in the preparation of the Income Tax Calculator which includes:

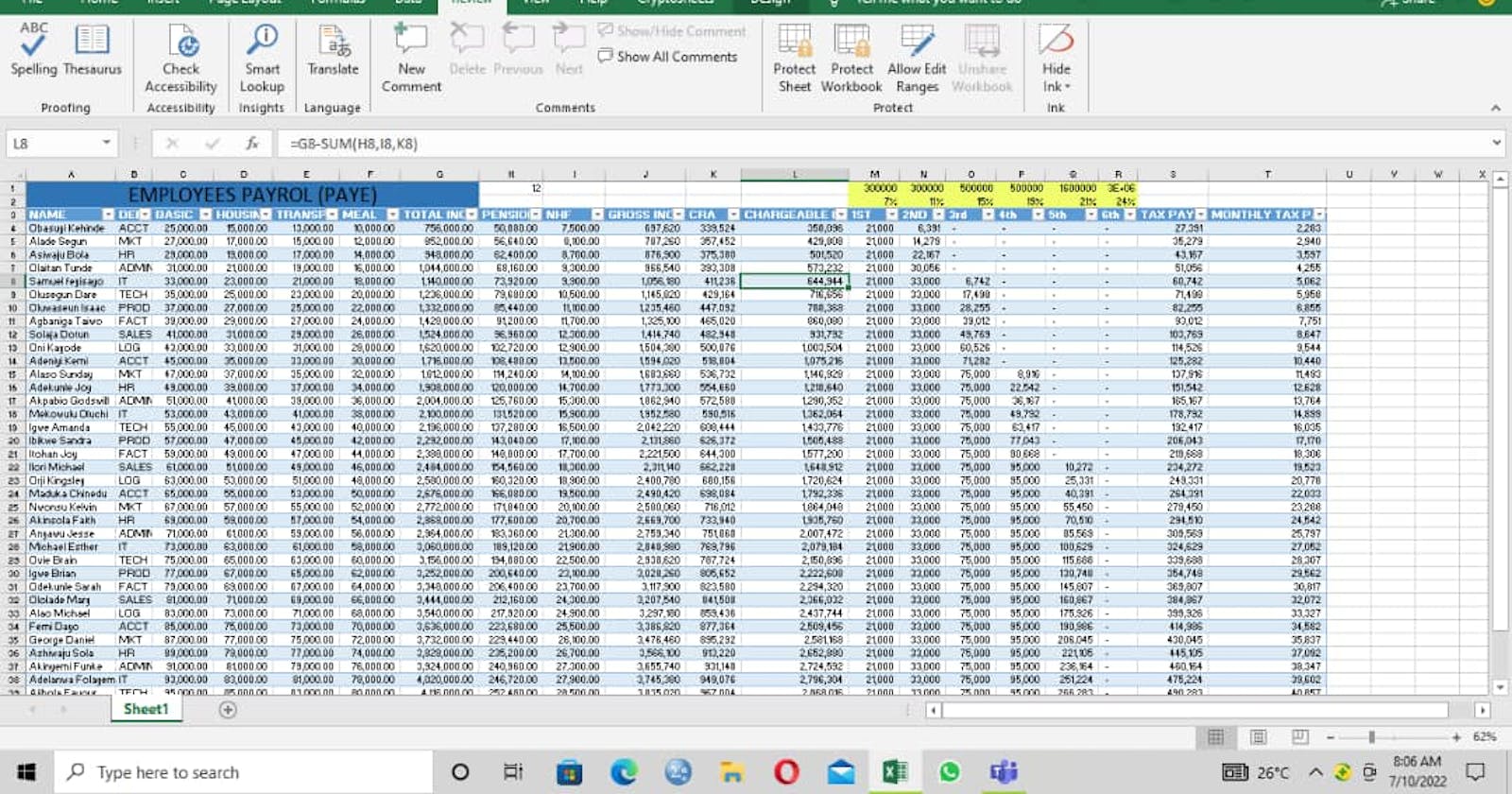

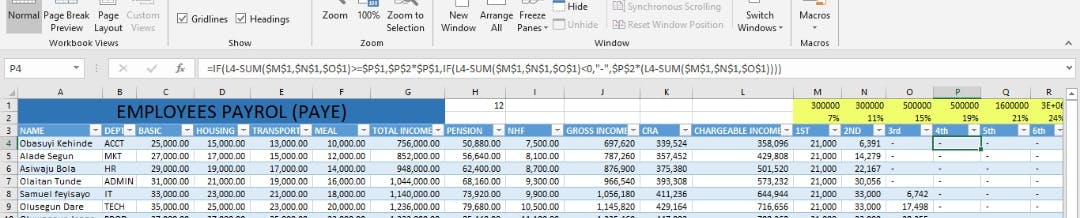

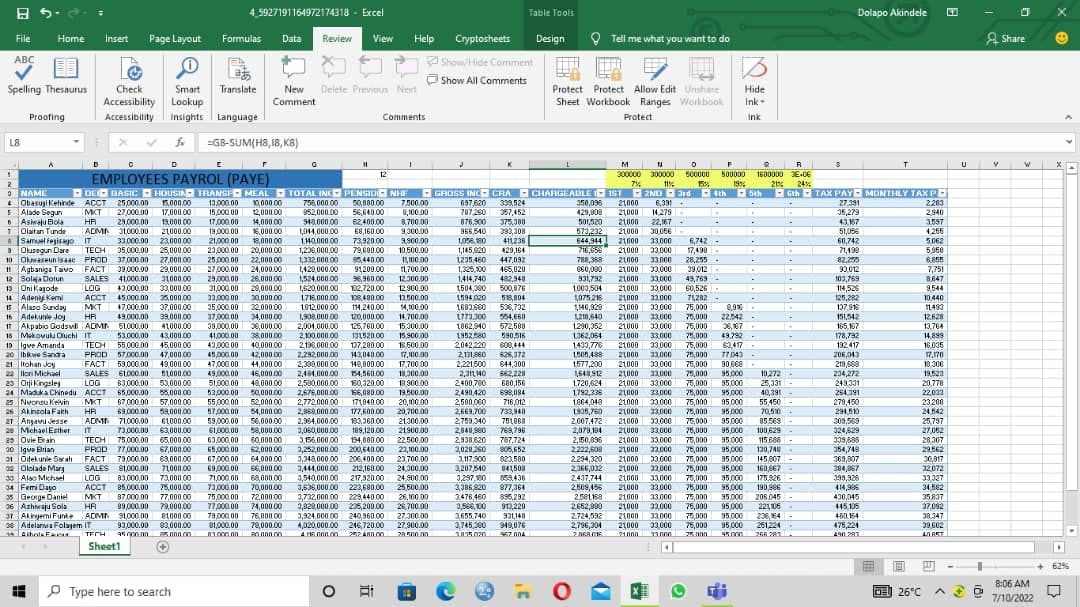

- Open a new excel worksheet and create a table containing the following headings; Name, Department, Basic, Housing, Transport, Meal, Total Income, Pension, National Housing Fund(NHF), Gross Income, Consolidated Relief & Allowance(CRA), Chargeable Income, Tax Rate Percentages (7%,11%,15%,19%,21%&24%), Tax Payable and Monthly Tax Payment.

- Fill in the necessary available values for the headings; Name, Department, Basic, Housing, Transport and Meal.

- To calculate the total income, we add up the values of the basic, housing, transport and meal income together. Note: The total income is to be calculated annually .i.e. Total income multiplied by 12.

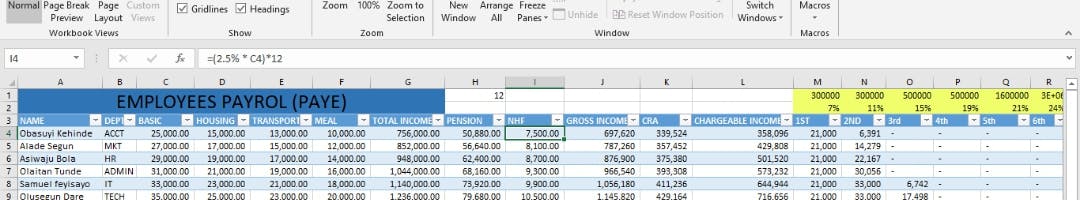

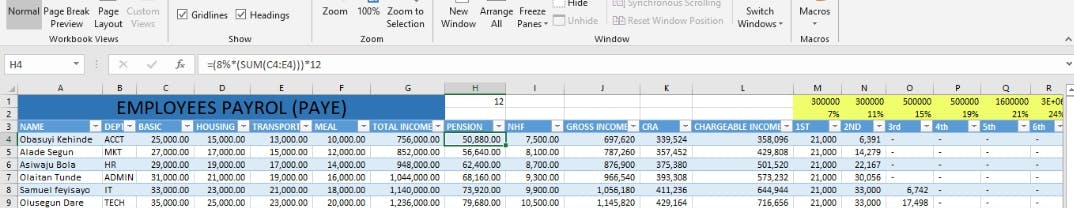

- To calculate the pension; pension is equals to the minimum of 8% of the sum of the basic, housing and transport income.

- To calculate the NHF; NHF is equals to 2.5% of the basic salary.

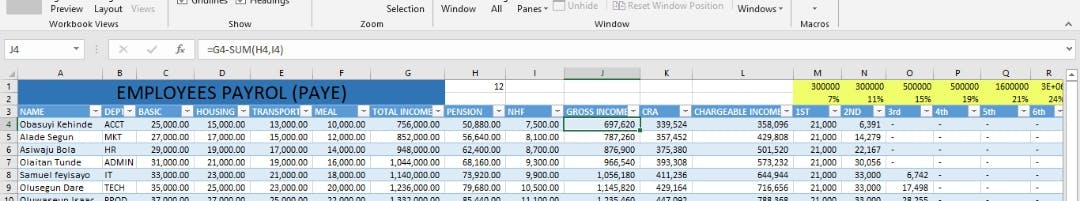

- To calculate the gross income; gross income is equals to total income minus the sum of the pension and NHF.

- To calculate the CRA; if 1% of gross income is greater than 200,000, then CRA is equals to 1% of gross income plus 20% of gross income, else, CRA is equals to 200,000 plus 20% of gross income.

- To calculate the tax rate percentages; in Nigeria, according to the tax rate calendar, for every first 300,000 of your chargeable income, you are going to pay 7%. The next 300,000 after deducting the first 300,000, you pay 11%, then if the remaining money after that is less than or equal to 500,000, then you pay 15%. Then the process repeats itself for the next 500,000 @ 19%, 1600000 @ 21% and 3200000 @ 24%. Note: For minimum tax; if your chargeable income is less than the first 300,000, then you pay 1 % of your chargeable income.

- To calculate the tax payable; tax payable is equals to the sum of the values gotten for the tax rate percentages.

- Finally, to calculate the monthly tax payment, you divide the tax payable by 12.

OVERVIEW OF PROJECT WORK

Below are the images of the income tax calculator prepared in Excel.

This worksheet shows the preparation of the income tax calculator, this implies that there is an efficient method of creating an income tax calculator in Excel.

RECOMMENDATION

There are various guide in preparing an income tax calculator. Furthermore, there are practical ways on How to Calculate Income Tax in Excel along with practical examples and a downloadable excel template. You can also go through our other suggested articles which include:

- educba.com/calculate-compound-interest-in-e..

- educba.com/nper-function-in-excel

- educba.com/calculate-age-in-excel

CONCLUSION

A worksheet is a useful tool to ensure that the accounting entries are correct. An accounting spreadsheet of the company is a document used within the accounting department calculate and analyze the account balances. All the accounts of the accounting records of the company are shown in the accounting worksheet in at-least one of the columns, which is an essential step for preventing the errors when the company’s final financial statements are prepared.

At the end of this project, we provided an income tax calculator without the help of an accountant. Moreover, we have successfully prepared an Income tax calculator to help analyze our taxes.

Click on the link below for more information about the analysis. docs.google.com/spreadsheets/d/1d8jKEwcs87O..